Investing in a commercial space—whether buying or leasing—comes with a host of responsibilities and decisions. Unlike residential real estate, commercial properties are tied more directly to business success. That means the stakes are higher, and a thorough evaluation is key. From location and zoning to infrastructure and security, there are many aspects to weigh carefully. If you’re looking to make a smart move, it’s essential to look beyond just the price tag or aesthetics. A well-informed decision now can save you costly surprises down the road. Here are some practical tips to guide you through evaluating commercial properties with confidence.

Analyze the Location and Surrounding Area

Start by looking at the property’s location—not just in terms of address, but also the surrounding neighborhood. Is it in a high-traffic area, or tucked away where visibility might be a challenge? Consider how easy it is for customers, employees, and deliveries to access the site. Check the condition of nearby roads, public transport availability, and parking options. The proximity to other businesses can also affect foot traffic and brand image.

Some areas may be saturated with competitors, while others may offer a prime opportunity. It’s also smart to investigate future development plans in the area, as these could either increase the property’s value or complicate your operations. Don’t forget to visit the site at different times of day to observe activity and noise levels.

Review Zoning and Land Use Regulations

Before you get too attached to a property, double-check its zoning classification. Zoning laws determine how the property can legally be used—whether for retail, industrial, office, or mixed-use purposes. Even if the building suits your needs, you’ll want to be sure your intended business type is allowed. Reach out to the local zoning department or check municipal zoning maps online.

If you’re considering renovations, remember that those changes may also be subject to local codes. Some properties may fall within special planning areas or heritage zones, which can further complicate changes. You don’t want to find yourself locked into a lease or purchase only to discover you’re restricted from operating the way you need to. It’s always a good idea to consult with a land use attorney or city planner to avoid potential headaches.

Inspect the Building’s Structure and Condition

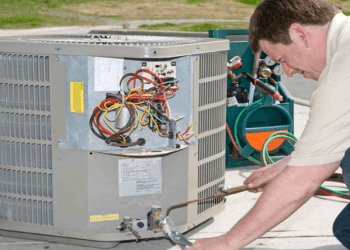

A visual inspection isn’t enough when you’re dealing with commercial properties—dig deeper into the building’s bones. Hire a professional inspector with experience in commercial buildings to assess structural elements like the foundation, roofing, plumbing, HVAC, and electrical systems. Older properties can hide issues that are costly to repair or may not comply with current safety codes. Pay special attention to signs of water damage, mold, or pest infestations, especially in areas that aren’t frequently used.

Evaluate how energy efficient the building is, and whether it might require upgrades to meet modern standards. If the building includes elevators, fire suppression systems, or backup generators, these too need thorough evaluation. Document all findings and factor repair or upgrade costs into your budget calculations.

Evaluate the Security and Access Systems

Safety should be a top priority, not just for the sake of compliance, but also for peace of mind. Take time to assess the property’s current security features, including surveillance cameras, alarm systems, lighting, and perimeter fencing. More importantly, examine how access to the building is managed. Are there electronic keypads or card readers in place? What’s the procedure for after-hours entry?

One key area that’s often overlooked is the commercial door entrance systems. These systems control who comes in and out and play a vital role in both security and functionality. Check if the entrances are accessible, durable, up to standard, and delivered by trusted companies—especially if you expect high volumes of traffic. An outdated or faulty system could compromise safety and slow down operations, so it’s worth the close look.

Consider Utility Capacity and Infrastructure

The building might look great, but can it support your operations? Check the capacity and condition of all utility connections—electricity, water, sewage, gas, and internet. Depending on your business, you may need more power or data capacity than a typical tenant. Ask for utility bills from the past 12 months to get a sense of what to expect in costs. This can also help you identify inefficiencies or outdated systems.

Take note of the heating and cooling systems, as these often contribute heavily to utility expenses. It’s also wise to investigate how waste is managed on the property, especially if your business generates a lot of it. Inadequate infrastructure could limit growth and lead to expensive upgrades down the line.

Assess Legal and Financial Considerations

Don’t skip the paperwork. Review any existing lease agreements if you’re buying, or lease terms if you’re renting. Pay close attention to responsibilities for maintenance, taxes, insurance, and any additional fees like common area expenses. Look into the property’s history—are there any ongoing legal disputes, environmental issues, or liens? It’s also a good time to consider whether the price or rent aligns with market rates in the area.

A professional appraisal or a commercial real estate broker can offer valuable insights here. Having a clear understanding of all financial obligations and potential risks will allow you to plan your budget more accurately. This step might not be exciting, but it’s essential for making a well-rounded, low-risk decision.

Think Long-Term: Growth, Flexibility, and Resale Potential

Finally, step back and think beyond your immediate needs. Will this property still serve your business in five or ten years? Consider whether the layout is adaptable to changes in operations, staffing, or equipment. Does the property allow for expansion, or will you be forced to move when you grow? A flexible space gives you options and protects your investment. It’s also worth considering the resale or sublease potential. A location that appeals to a wide range of businesses may be easier to lease or sell later if needed. Market conditions change, and having a versatile, well-located commercial property can act as a financial cushion if plans shift unexpectedly.

Buying or leasing commercial properties isn’t a decision to rush. With these smart tips, you can approach the process with a clearer understanding of what to look for—and what to avoid. A little due diligence now goes a long way toward securing a space that truly supports your goals.